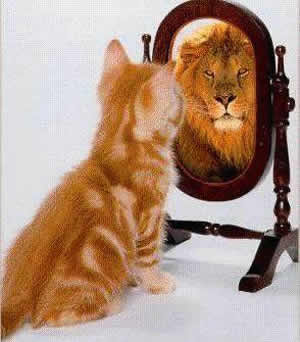

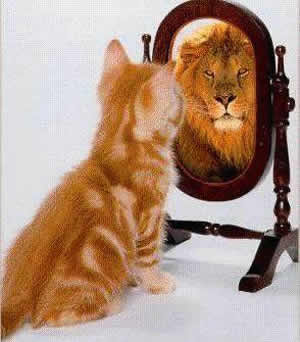

Think Like The Rich: Change Your Mind, Change Your Life

- “All of us have the power of choice. I choose to be rich, and I make that choice every day.”

- "Money is just an idea."

- “There is nothing more powerful than an idea whose time has come, and there is nothing more vulnerable than someone who is still thinking old ideas.”

- Once you know the truth beneath your negative statements, talk back to them. Start an argument with yourself! Think of ways to counter each one.

- Some strengths that are common to people who succeed in business and investing:

- Vision—the ability to see what others do not see

- Courage—the ability to act despite fear

- Creativity—the ability to think outside the box

- Self-confidence—the ability to withstand criticism

- Self-control—the ability to delay gratification

- It’s important to keep your eyes and ears open—and to know where you are. Only then will you spot opportunity when it crosses your path.

- Today retirees need more financial resources at retirement and more-sophisticated ways of building assets than were offered by the pension plans of the industrial age.

- Throughout history, 90 percent of the money has been made by 10 percent of the people.

- The times are rapidly changing, and if you want to be rich, your approach to money and investing has to change too.

- “You can’t help but get older physically. That doesn’t mean you have to get older mentally.”

- If you want to stay young longer, adopt younger ideas.

- “Rich Dad’s approach is simple but very profound: You can take what’s in your head and turn it into cash flow.”

- Focus my sights not on what others think is good for me, but on what I want.

- Most of us grew up thinking that mistakes are bad and should be avoided at all cost. We tend to correlate mistakes with low intelligence: The more mistakes you make, the dumber you are. However, mistakes were opportunities to learn something new.

- “There’s a bit of magic hidden in every mistake. That magic is called learning.”

- “Some of the biggest failures I know are people who have never failed.”

- “Investing isn’t risky; not investing is risky.”

- Enact a sound plan, and you can turn risk into riches.

- On the road to riches some risk is inevitable, but if you keep a cool head and improve your financial literacy, you can manage it.

- Recognize these personal obstacles, you can overcome them! What are they?

- Fear

- Cynicism

- Laziness

- Bad habits

- Arrogance

- Disappointment

- “The primary difference between rich people and poor people is how they handle fear.”

- John D. Rockefeller said, “I always tried to turn every disaster into an opportunity.”

- Losers are defeated by failure. Winners are inspired by it.

- The more education you have, the less risk there will be.

- “Cynics criticize and winners analyze.”

- Cynicism blinds you to opportunities, while analysis opens your eyes to possibilities.

- “Losing is part of winning.”

- Think of things you don’t want to happen and things you do want to happen. If your don’t wants outweigh your wants, you may be letting doubt and fear close your mind instead of open your eyes.

- If you’re in doubt and feeling afraid, do what Colonel Sanders did to his little chicken—he fried it.

- Busy people are often the laziest.

- Isn’t greed bad? Too much of it, yes. An excess of anything is bad.

- In truth, guilt is worse than greed. Guilt stifles dreams.

- The question “How can I afford it?” opens up avenues to our dreams.

- “The words ‘I can’t afford it’ close your mind, while the words, ‘How can I afford it?’ open your mind. The human spirit is powerful—it knows it can do anything.”

- “Pay yourself first.”

- “Creditors are bullies. And because they’re bullies, the pressure to pay them will be so great that it will force you to seek sources of income other than what you’re making working for someone else.

- “Arrogance is ego plus ignorance.”

- “Prepare yourself for disappointment, and you’ll turn disappointment into an asset.”

- “When people are lame, they love to blame.”

- Preparing yourself for disappointment doesn’t mean you won’t still be upset and concerned. But if you’re prepared, you won’t beat up on yourself too hard. This is important, since being too hard on yourself will make you overly cautious about taking risks or trying new ideas. If you can face your failures, control your emotions, and use disappointment to learn new financial skills, you’ll flourish.

- If you’re prepared, you’ll react with calm to failure, learn from it, and move on.

- “Broke is temporary, poor is eternal.”

- While fear reflects disappointment and passivity, passion reflects confidence and energy.

- More than anything, getting rich is a matter of confidence—of changing your thinking from “I can’t” to “How can I?” Once you commit to this way of thinking, once you make up your mind not to let anything get in the way of success, you’ll be on your way

No comments:

Post a Comment